A historic climate bill just passed by the U.S. Congress could have implications in entrenching Canada's role in the shift toward clean transportation.

The legislation that passed last week established preferential tax treatment for electric vehicles assembled anywhere in North America.

That made-in-North-America approach generated some news headlines by bringing an amicable resolution to a months-long Canada-U.S. irritant.

Less noticed in the bill was a pot of money containing hundreds of millions of dollars to jump-start a new domestic industry in components for electric-vehicle batteries.

The ripple-effects could eventually be felt across the border, up into remote Canadian mining communities.

At issue is growing U.S. concern about becoming dependent on its great geopolitical rival, China, for the critical minerals powering future vehicles.

President Joe Biden invoked the U.S. Defense Production Act earlier this year allowing him to fund projects that would lessen dependence on U.S. rivals.

He's now getting the funds to do it: $500 million US set aside in this incoming law, after another $600 million was tucked into a recent Ukraine assistance bill, atop an older multibillion-dollar loans program.

Those funds are now at Biden's disposal to enact his stated plan to develop new suppliers for lithium, nickel, cobalt, graphite, and manganese, as well as heat pumps.

An 'opportunity' for Canada

Could some of that money create new battery-component projects in Canada? Canadian officials are hopeful it will.

They point to a document recently posted on the White House website, from a binational panel: It explicitly mentions Canada being included as a domestic source under the U.S. Defense Production Act and says that creates potential cooperation opportunities on critical minerals.

"There is an opportunity the way [the bill is] structured — to take advantage of some of that," Kirsten Hillman, Canada's ambassador to Washington, told CBC News in an interview.

"This will spur domestic production [in the U.S.]. It also includes Canada as a domestic source. So we look forward to shared opportunities."

The broader story of the new bill, which Biden will soon sign, is that it's by far the most significant U.S. federal action ever against climate change.

It passed with relatively little media coverage last Friday, with the country's politics distracted by the FBI search of former president Donald Trump's home.

What's in that big climate bill

But analysts who've studied the bill have predicted a major impact on carbon emissions through its more than $400 billion Cdn in tax credits and subsidies for a wide range of energy projects.

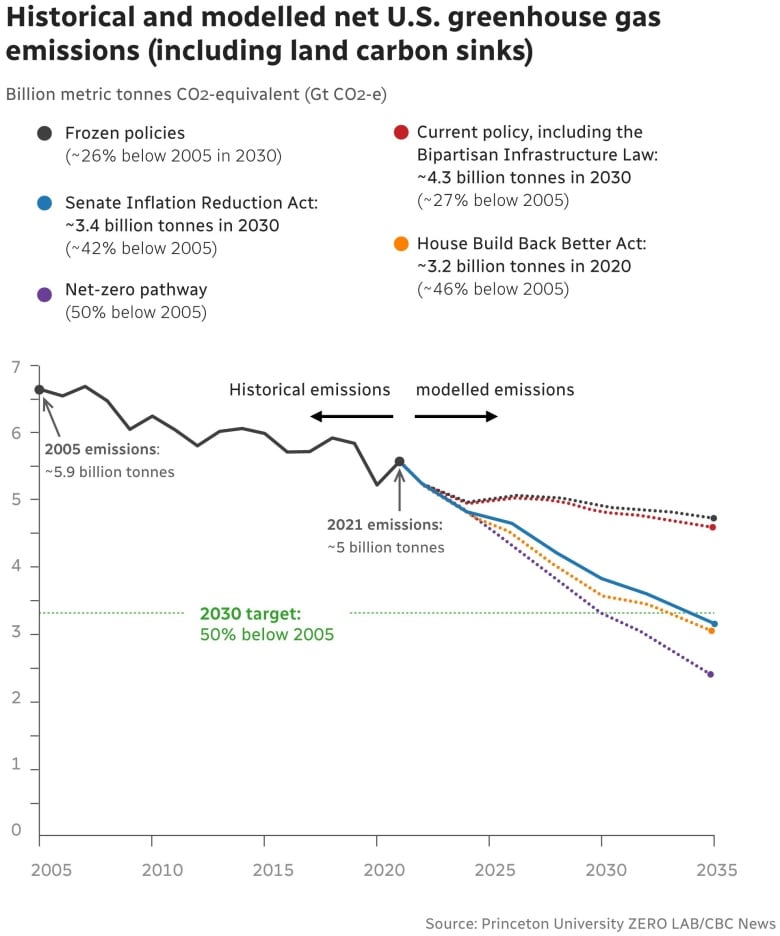

Those estimates project U.S. greenhouse-gas emissions will fall faster now to anywhere between 31 per cent and 42 per cent from 2005 levels, which would take the U.S. significantly closer to achieving its 2030 target under the Paris accord.

The so-called Inflation Reduction Act would remove one billion tons of greenhouse gasses from the atmosphere, says Princeton University's Zero Lab – that's equivalent to reducing two per cent of all current global emissions.

But there's uncertainty in the projections: One reason the estimates vary so widely is it's far from clear how quickly new energy projects will get started.

Here's an example of that uncertainty: The much-discussed electric vehicle credit.

For almost a year, it was a festering irritant in Canada-U.S. relations. An earlier version of the bill, previously known as Build Back Better, allowed only U.S.-assembled vehicles to access certain tax credits.

What happened to that EV tax irritant?

That triggered threats of trade retaliation. Ottawa warned that the bill violated the new North American trade deal and would wipe out auto jobs and investment in Canada.

The head of Canada's Automotive Parts Manufacturers Association, Flavio Volpe, called the friendlier language in the new, final, bill a relief for Canadian jobs: "It's a bullet dodged," he said.

"Probably more of a missile dodged."

But wait. There's an important caveat in the new, friendlier language. U.S. auto-makers are now calling the new credit practically useless, under current conditions.

For an electric car to qualify for the maximum $7,500 US in the new version of the credit, the car's battery will increasingly need North American components: from 50 per cent of the battery in 2024, to 100 per cent in 2028.

The problem? North America doesn't make that many battery components.

"[No vehicles] would qualify for the full credit when additional sourcing requirements go into effect. Zero," said a letter from a U.S. auto industry lobby group.

An analysis for the non-partisan U.S. Congressional Budget Office projected that only a tiny percentage of vehicles will wind up receiving the tax credit.

In a 10-year fiscal forecast for the bill, the CBO estimated the U.S. treasury will wind up paying out just enough to deliver the full credit to slightly over 1 million vehicles over a decade.

That amounts to less than one per cent of an estimated 150 million total vehicle sales in the U.S. over those 10 years. During that period, an increasing percentage of vehicles sold will be electric.

The bottom line: Very few cars are expected to have enough North American components to qualify.

That's where Canadian mining comes in.

A key architect of the final version of the bill, U.S. Sen. Joe Manchin, has repeatedly stated his skepticism about the original plan.

He said it made no sense to rush into the electric-vehicle age while America's chief adversary still has a stranglehold on vital inputs.

But after Manchin visited Canada earlier this year, he opined that the two countries should be working more closely together on minerals.

This new bill appears designed to do just that, through the tax credits for North American vehicles, and the cash for critical-minerals projects.

If U.S. mining companies want access to some of that money, they can submit proposals to the American government.

Quebec mining project

One company eyeing U.S. public funds happens to have an important investment in Quebec.

Keith Phillips, president of North Carolina-headquartered Piedmont Lithium, said he's not yet clear on what conditions the U.S. government will set and what projects it's looking to fund.

More details about the administration of the bill will be revealed in regulations to be drafted in the coming months.

"I'm not sure anyone's entirely clear on what the priorities are," Phillips said in an interview.

His company is a minority investor in a Quebec lithium mine that's now forecast to begin producing next year.

The next goal is to build a plant in Quebec for value-added processing with the majority partner, Australia's Sayona Mining.

The project is in its infancy and there's no site picked out yet.

Phillips said a similar plant would cost $600 million US to build in the U.S. and he said public money is a lifeline for projects that banks have little history of supporting.

"Of course it would be a priority," he said of figuring out the potential for U.S. federal loans.

"If government assistance could be involved, it's very helpful."

Building a North American battery industry

The Canadian government also recently budgeted $4 billion to develop the country's critical minerals sector.

Yet North America is starting way behind.

Canada, for instance, has a minute share of the world's discovered deposits of lithium, cobalt and manganese.

Brian Kingston, head of the Canadian Vehicle Manufacturers' Association, said he's relieved by some of the changes in the U.S. bill.

But he's still concerned – that auto-makers can't meet the zero-emissions sales targets set by Ottawa without major improvements, in charging capacity, energy infrastructure and sales incentives.

As for a North American battery supply chain, he said: "[It] won't emerge overnight."